Navigating Market Challenges: Lessons from Canada’s Transition Stars

Canadian small and mid-cap equities continue to face a challenging environment. Capital has been flowing to international markets, passive investing is gaining momentum, and a trade war with our largest trading partner, the U.S., has added further uncertainty.

While today’s challenges are frustrating, our long career in the Canadian capital markets reveals similar periods of difficulty for small and mid-cap diversified companies. These include the commodity boom, where liquidity in the Canadian market concentrated in the energy and mining sectors, economic uncertainty during the Great Financial Crisis, and the recent pandemic. Despite these headwinds, several small/mid-cap companies not only survived but thrived, transitioning into large-cap firms by growing their businesses and creating strong shareholder value.

Today, we examine the companies that have made this transition, identifying key factors behind their success, and offer insights for current small and mid-cap management teams and investors.

Meet the “Transition Stars”

To identify companies that successfully transitioned to large-cap status, we screened diversified companies (excluding financials and REITs) in the S&P/TSX Composite Index that met the following criteria.

Have grown their market cap to between $9B and $14B

Have been publicly listed for over 10 years

Have outperformed the TSX Total Return Index over the past decade.

As highlighted in the table below, these “Transition Stars” have experienced significant growth over the past ten years, increasing their average market cap from $3 billion to $12 billion and generating a 10-year average Total Shareholder Return of 17.3%, outpacing the TSX Total Return of 8.7% and the S&P 500 of 13.2%.

The Transition Stars

Source: Tegus, Company reports.

*10-Year Total Return based on closing year-end prices ended December 31, 2024; Colliers and FirstService start date of end of Q2/15

This strong outperformance was driven by an average 12.7% revenue growth CAGR, a greater 15.2% CAGR in EPS and an average ROE of 17.8%.

Source: Tegus, Company reports, IronBird Advisory estimates

Common Success Factors

While these companies benefitted from operating in large addressable markets, having asset-light business models and reinvesting cash flow at above-average rates of return, they also share additional similarities that align with the successful traits we have uncovered during our 20+ years covering or investing in the diversified small/mid-cap sector. We have provided a summary of the key similarities below.

Accretive Acquisition Strategy: While organic growth was central to the Transition Stars’ success, acquisitions played a critical role in expanding revenue and creating shareholder value. As seen in the table below, collectively they completed over 300 acquisitions in the past decade. FirstService led the way with approximately 100 acquisitions, while Toromont was the least active with four.

Accretive Acquisitions Were a Key Driver to Growth

Source: FactSet, Company reports

The acquisitions primarily served two purposes — increasing market share in fragmented existing markets (a common strategy across all companies) and expanding into new verticals to enlarge the addressable market size, enhance revenue stability or access complimentary markets.

In our view, the expansion into new verticals is an important take-away for small and mid-cap management teams facing growth constraints in their current markets. Rather than defaulting to returning cash to shareholders through dividends or buybacks, these companies demonstrate that identifying a complementary new market vertical that meets return thresholds can provide companies opportunities for long-term growth and the ability to transition into large cap companies.

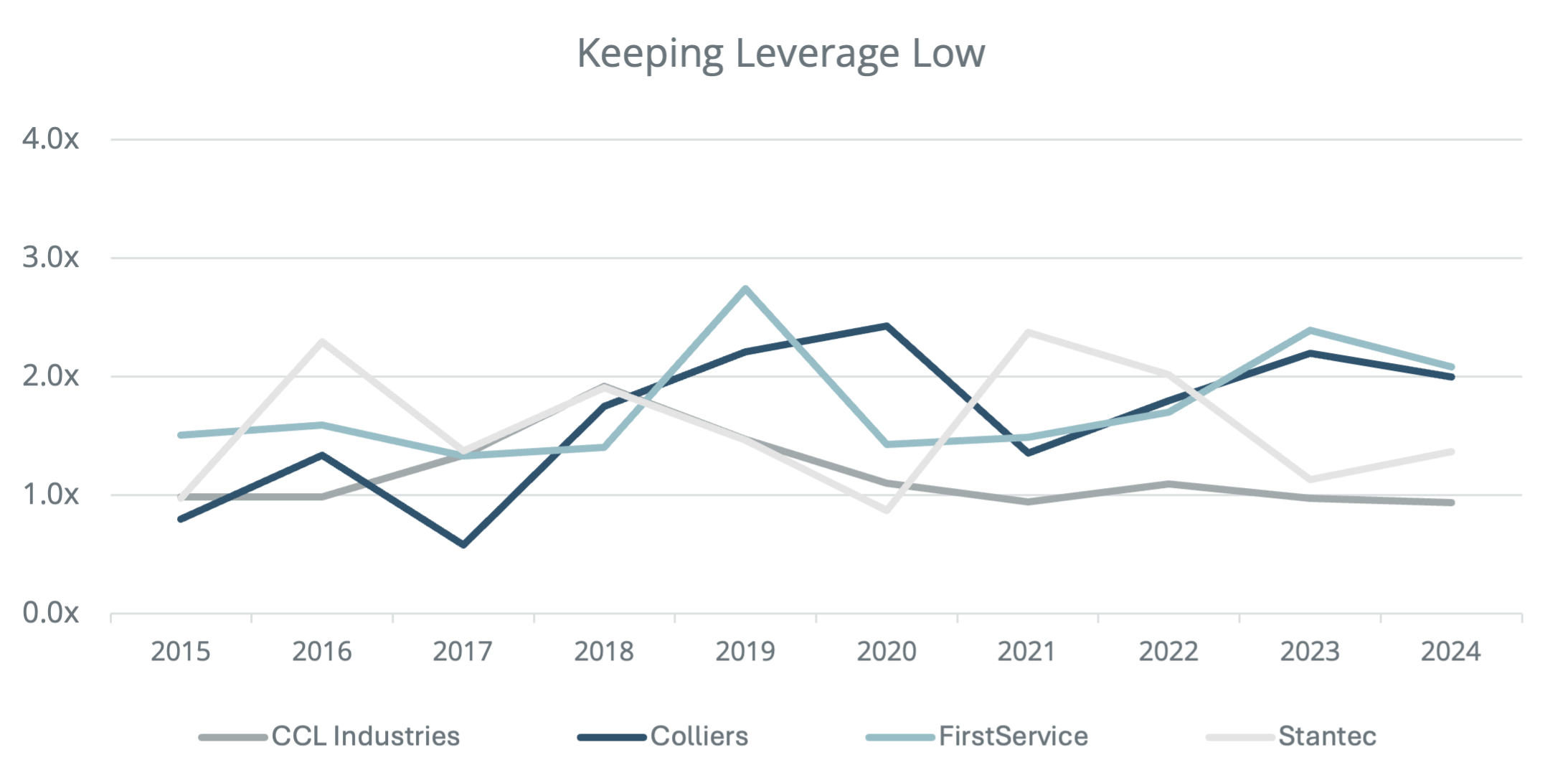

Maintaining A Prudent Balance Sheet: A defining trait of the Transition Stars was financial discipline. Despite generating strong free cash flow and proving their operational resilience, they all maintained a conservative balance sheet, often citing it as a key driver of success.

The most conservative companies — Toromont and Descartes — held net cash positions over the majority of past decade. Excluding these two, the others maintained an average net debt/EBITDA ratio of 1.5x.

Source: Tegus, Company reports, IronBird Advisory estimates

While some argue that capital light businesses can sustain higher debt levels, our experience in Canadian capital markets suggest that the Transition Stars’ approach is prudent. A conservative balance sheet strategy helps companies withstand economic downturns and aligns with the risk preferences of Canadian investors. Based on our experience, companies with net debt/EBITDA ratios above 3x have often faced valuation discounts, limiting future growth opportunities.

A Focus on Returns — Each in Their Own Unique Way: Given the Transition Stars’ long-term success, it’s clear that a focus on generating strong returns has been crucial. However, the way each company prioritizes and measures returns varies. Toromont and CCL, for example, target ROE, while Stantec prioritize ROIC. FirstService and Colliers, on the other hand, focus on maximizing shareholder value through a broader approach. Interestingly, Descartes has not publicly disclosed a specific focus on a particular return metric, yet their exceptional shareholder returns over the past decade speak for themselves.

To illustrate the emphasis these firms place on returns, here are some quotes from the companies who have shown a consistent focus on returns:

“Without compromising safety or our balance sheet, we strive to grow earnings to support an 18% after-tax return on opening shareholders’ equity over a business cycle while growing our annual dividend. We then empower our business units to deploy capital to achieve our objectives.” Toromont 2016 Annual Report and this same goal remains in place today.

"Our Intense focus on creating value for shareholders, together with our enterprising culture, has always been the differentiator.” Colliers 2023

“Creating Value One Step At A Time” FirstService, front page of all Annual Reports

Based on our experience observing the evolution of the Company’s quoted above, we believe that this intense focus on returns has been a big part of these companies’ success and has set them apart from their competition.

Capital Allocation: Growth Focused with Low Payout Ratios and Opportunistic Buybacks: With strong emphasis on growth and reinvestment at a high rate of return, the Transition Stars maintained a low dividend payout ratio, ranging from 0% (Descartes) to a modest 4% (Colliers), and an average of 27% across the rest of the group.

On the buyback front, all companies repurchased shares opportunistically when valuations were depressed, however this was not the primary use of capital. While most companies raised equity at some point to support their growth, dilution was modest with the average share count increasing ~13% over the ten years, except for Colliers which saw a ~40% increase.

Stable Leadership: CEO stability was a common theme, with four of the six companies having only one CEO over the past decade. The other two, Stantec and Toromont, each had just two CEOs during the period. We believe that this stable leadership combined with an engrained focus on returns contributed to their long-term success.

While strong investment returns are often linked to founder-led companies and high management ownership, this pattern was not consistently observed here. Only one founder, the Chairman of FirstService and CEO of Colliers, remains actively involved and CEO ownership was not a determining factor in success, as these companies’ demonstrated success with varying levels of CEO shareholding. For instance, Descartes’ achieved one of the highest revenue, earnings growth and shareholder returns despite the CEO holding one of the lowest ownership positions.

Looking Ahead

Despite their significant growth, the long-term outlook for these Transition Stars remains strong. Their ongoing ability to identify and execute high-return growth opportunities while maintaining financial discipline positions them well for continued success.

At IronBird, we are passionate about helping public companies navigate the complexities of capital markets. If you are looking to sharpen your focus and strategy to align with long-term growth objectives, whether you’re a small company striving to scale or a mid to large-cap company navigating the next natural evolution of growth, we’re here to help. Reach out to us—we’d love to be part of your journey to become the next Transition Star!